|

|

| Blog |

|

| Archive |

|

Q1/15 Q4/14

|

|

|

| Blog |

| To find an archived article, simply click on Index and scroll the subject titles, or do a Ctrl-F search |

TALLRITE BLOG You can write to me at blog2-at-tallrite-dot-com |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

“Ill-informed and

objectionable”;

“You poisonous, bigoted, ignorant, verbose little wa*ker.” (except I'm not little - 1.97m) Reader comments |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Myspace Clocks, Video Clocks, Flash Clocks, Fun Clocks at WishAFriend.com |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

ISSUE #218 - January 2012 [355+2243=2598] |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

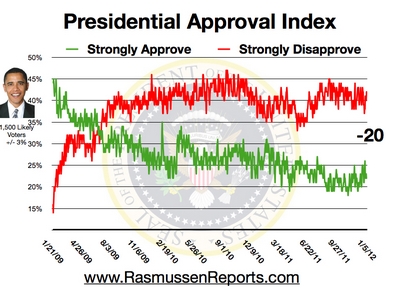

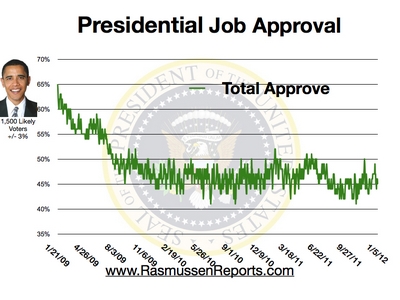

Back to President Obama’s (un)popularity; date is on the charts. (Click to get the latest version.) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Truth About Fraccing - 3rd January 2012 Alternative URLs: Fraccing is an old technique, but due to advances in sophisticated technology it is enjoying an unparalleled renaissance and creating an energy revolution of astonishing proportions This post is divided into six parts: The negative publicity that has been swirling round the world about hydraulic fracturing for the past year or so has been driving me nuts. Lots of things drive me nuts but usually it is because I have might have a different opinion about something, for example whether or not Barack Obama has the faintest idea of his duties as an American president. But what drives me nuts about fraccing is not an issue of opinion but of facts. Let's start with the word. Within the oil and gas extraction industry it has been spelt with two Cs for as long as hydraulic fracturing has been routinely practiced, which is over half a century. But when the media suddenly woke up to the word they immediately spelt it fracking, not bothering with even a phone call to check the correct spelling. Of course these are the same media people who think “media” (print, radio, TV, internet etc) is a singular noun, not the Latinate plural for medium, so they clearly have spelling issues. Then there's the “novelty” of fraccing. But after fifty years of successfully improving hydrocarbon production rates across the world by applying this technology, it is by no means a novelty. It is a novelty only for media too lazy to do a bit of Googling or make a few phone calls. Finally, there is the environmental threat that fraccing imposes. Of course anything with that toxic word “environment” is an instant publicity-grabber, which is why this entirely invented scare has gained so much traction. But this merely reflects the media's boundless enthusiasm for carrying out no research or fact-finding whatsoever. Emotions rule in that strange world of illiteracy and sloth. So let's have a look at what fraccing actually is. It's all pretty simple. An oil and/or gas reservoir is not a big swimming pool waiting to be drained. Think of it instead as a giant, solid sponge, ie rock full of pores, each pore being filled with, typically, a bit of water with a bit of oil on top and a bit of gas on top of that. The ratio of pores to sponge-rock is called the porosity - the higher the porosity the more fluids are present. The porous sponge-rock material will usually be

When a well is drilled into the middle of the porous sponge-rock, or reservoir rock as it is known, the fluids will flow only to the extent that one pore is connected to another, which is known as permeability.

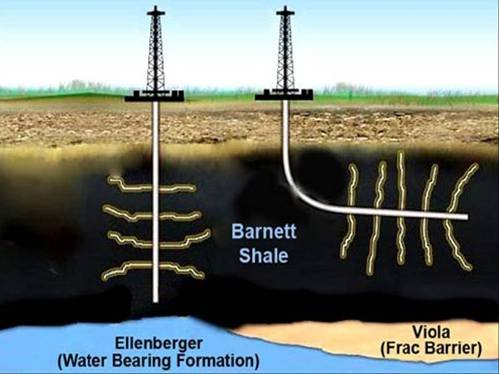

Where both porosity and permeability are low, as they always are with shales, you can have a real problem on your hands. This is exacerbated where the oil happens to be viscous, flowing more like treacle than petrol. That's where fraccing comes in. It's a simple concept. A well is drilled through the reservoir rock layer. Water is then pumped at ever higher pressure into the reservoir-rock until it simply cracks open. The resulting fractures make a much larger area of the reservoir-rock open to the wellbore, which therefore increases the flow of fluids into the wellbore. There are refinements of course. For example,

Some of these additives happen to be toxic, so when the treated water is recovered from the well it is either cleaned to facilitate safe disposal or else stored for re-use on another well. This is no different in principle from the way nasty waste water is responsibly dealt with in countless other industries. The wells themselves can be very sophisticated when tackling the low-porosity-low-permeability problem. Advances in directional drilling have been key: this is the technology whereby wells don't have to be drilled vertically, they can be steered in very precise pre-determined directions through the rock. Though in former years wells would be drilled vertically before fraccing, these days such wells will always be turned to a horizontal direction within the reservoir rock layer which it will then penetrate for a kilometre or more in order to maximise exposure to the well bore when fracced. For the same reason, they will often also be drilled “multi-laterally”, meaning that as the well enters the reservoir-rock, it will divide into several distinct fingers reaching through the reservoir. Individual fraccing operations are then carried out in sequence, tailored for each such finger. Modern seismic technology (which detects the shape of subterranean rock strata by bouncing sound waves off them) also permits ever smaller reservoirs to be detected. Using directional drilling techniques, these are then accessed with wells that snake along tortuous paths several kilometres long, like a jet-fighter stalking its prey, before veering horizontal and sprouting fingers. Just imagine the engineering sophistication that causes all this to happen, when all you - at the surface - can do is

Once fracced, the next job is to produce gas and/or oil from the reservoir in order to get a return on investment. Sometimes, fraccing alone will suffice. Sometimes flow has to be helped along (“stimulated” in the jargon) by for example drilling injection wells nearby, and pumping fluids (such as steam) down and along their fractures until the reservoir hydrocarbons are forced into the fractures of the producing wells. In any event, the end product is oil/gas that must be treated in conventional fashion before sale. Now let's have a look at the objections. They generally fall into six categories. 4 Fraccing Criticisms Debunked

Notwithstanding what I have just written, there is however a way that fluids can theoretically migrate upwards from the reservoir and cause damage. The well itself can provide such a pathway unless it is properly designed and constructed according to the most elementary standards of what is known as well engineering (declaration: I am a well engineer). When a well is drilled, the hole is “cased”, that is lengths of steel pipe - known as casing - are screwed together and run into the entire length of the hole, after which liquid cement is pumped down and up the outside of the casing. When set, the cement bonds the casing to the rock, which prevents fluids from migrating along the outside of the casing. Measurements and tests are conducted to determine the integrity of the casing and of the bond and if necessary repairs are carried out. Thus a properly constructed well will leak fluids neither when they are pumped down the well into the reservoir rock, nor when fluids emanate upwards out of the reservoir-rock. However, just as a house from which an incompetent builder has left out a few roof tiles will leak when it rains, so a well which is incompetently drilled may also leak under pressure. The solution to such leaks is not to ban houses or wells, but to construct them properly, according to basic engineering norms and to put in place a suitably enforced regulatory regime. Imagine a world where an occasional mistake due to avoidable incompetence leads to the proscription of all activity in that field. We would have no technology at all - no aircraft, no medicines, no cars, no buildings, no internet, no nothing. It is an absurd proposition. In fact, none of the criticisms of fraccing stand up to scientific scrutiny. They mostly boil down to a fear of the unknown and a special suspicion of oil companies and their motives. The root cause of this is, of course, the oil companies' own abysmal record of explaining to the public what they do, how they contribute to global economic prosperity and development, and their own internal policies on ethics (this, for example). 5 Hydrocarbons Unleashed by Fraccing The boom in fraccing activities over the past few years has come about as a result of a perfect storm:

The results have

been truly astonishing. Just a few years ago, people were

earnestly wringing their hands about the imminence of so-called

“peak

oil”

and thereafter a global decline in production with catastrophic effects

on human welfare.

My main point was that as the oil price increases, so

In particular, the new availability of massive gas volumes as a result of fraccing are having a direct moderating effect on oil prices. This will become ever more apparent as modern techniques spread for converting gas to easily transportable liquid products, such as Shell's new GTL (gas-to-liquid) technology in Qatar. I remarked that “oil and gas are found not in the ground but in that unfathomable, inexhaustible resource that is the human brain”. And so - yet again - it has proved, thanks (and much to my own personal surprise) to that veteran technology, fraccing. For not only has fraccing continued to open up tight - that is, low-permeability - sandstones and limestones as it always had, but it is now able to set about shales. Shales are found everywhere and have long been known as repositories of hydrocarbons, particularly gas. But they have equally been regarded as far too tight to ever tackle, unless so close to the surface they can be dug out by open-cast mining and the rock heated and treated to squeeze out its precious cargo. Huge deposits measured in billions of barrels are already being extracted in this tedious way from, among others, Canadian tar-sands and Venezuelan bitumen. Modern fraccing techniques have, however, opened up the deeper shales all over the world as a whole new hydrocarbon resource comparable in scope to the massive oil finds of the last century. For example, the remarkable chart below appears in the December 2011 issue of the Energy Institute's Petroleum Review, December 2011 (p38). It shows how, thanks to fraccing, shales and other tight reservoirs have over the past few years dramatically reversed what was thought to be the inexorable thirty-year decline in America's gas reserves (CBM stands for coal bed methane, another newly exploitable resource).

Reserves will continue to climb, so that the days of American dependence on foreign energy (notably oil from the Middle East and Africa) now appear to be numbered. The US currently imports some ten million barrels a day, which costs a massive trillion dollars every three years. Drastically cutting oil imports because of the extra domestic energy liberated by fraccing has enormously beneficent implications for America and thus the world,

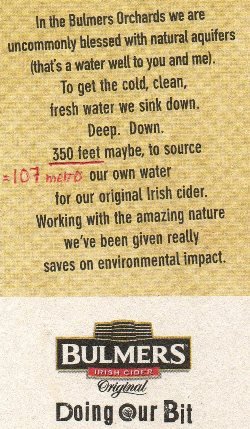

Moreover, while the numbers may differ, the general shape of both of the above two charts is similar throughout much of the developed world. Oil imports have been going up and up for decades as growth-driven demand has soared while production has declined. But suddenly fraccing has resulted in new gas and oil which are dramatically changing the domestic energy picture. The UK provides a further example. The British Geological Survey so far estimates that up to 150 billion cubic metres (5 trillion cubic feet) of shale gas exist onshore, which is the equivalent in calorific terms of some 900 million barrels of oil. This is equal to 18 months of the UK’s requirements and worth over £50 billion (€60 billion) at today’s prices. However, offshore shale gas in British waters, already prolific in terms of conventional oil and gas, is likely dwarf that available on land. We are truly witnessing an international energy revolution, the likes of which was inconceivable less than a decade ago. Forget what some people still say about “peak oil”: it is and always has been nothing but a Malthusian-style myth. Since this blog is written in Ireland, I have to end with the Irish angle on fraccing. Three companies have expressed an interest in exploring and fraccing shales for onshore gas – Tamboran Resources (Australian), Lough Allen Natural Gas Company (Irish) and Enegi Oil (Canadian). They have their eyes on 8,000 sq km spread over a dozen different counties. I cannot judge the technical merits of their proposals, but the few public utterances I have heard (eg here) have been suffused with ignorance of the technology, which does not bode well for their projects. Nevertheless the issue of fraccing within Ireland is moot.

No Fracking Ireland has no doubt been much inspired and encouraged by the successes of the Shell to Sea campaign which has for years been trying to stop or stymie Shell's development of the offshore Corrib gas field, though with exceedingly sparse scientific basis for its objections. (I wrote about this in some detail last November). Apart from garnering international attention, the major achievement of Shell to Sea has been to treble the costs and the delivery time of the project. This has not only delayed Ireland's energy independence but guaranteed that there will be no profits to tax for a very long time. But perhaps Shell to Sea's principle accomplishment is to turn Ireland into a pariah state as far as oil and gas investment is concerned. It will be a generation before the travails of Corrib will have been forgotten. Meanwhile, with Ireland's political risk in the order of 200-300% thanks to Corrib, any sane investor is far likelier to look to less politically costly environments, such as Iraq or Somalia or other hotspots, to sink their wells. Thus, you can be sure that whatever they may say in public, Tamboran and its colleagues will in fact never carry out any fraccing in the foreseeable future. No Fracking Ireland will probably claim credit for this, but it properly belongs to Shell to Sea. Meantime however, the rest of the developed (and less developed) world will continue to ride the crazy fraccing horse to energy independence and prosperity, leaving indebted Ireland behind.

Also

Late Note (August 2012)

Even Later Note (February 2013)

NOTE: I am happy to give

presentation(s) based on the above and related issues, free of charge

other than expenses (I am based in Dublin, Ireland). The usual

reaction to such talks is “I had no idea!”

During the week beginning 17th January, Ireland's nemesis, the Troika, came to town for its quarterly visit. The Troika comprises the IMF, the ECB and the EU Commission, the three bodies that have been lending sufficient money (€65½ billion) to Ireland to enable it to continue in business without bothering to eliminate its gigantic deficit that last year casually added yet another €25 billion to the national debt of over €120 bn.

As a result of the latest visit, the Troika once again gave Ireland a gold star for its obeisance. Two press conferences were then held on the same day but in different venues. First up were a couple of Irish ministers at the high table:

They made various breezy statements, and a couple of strange ones. One of these was that they had secured agreement that perhaps €2 bn of the proceeds from the sale of state assets could be diverted from paying down debt to so-called job-creation wheezes. However when this was put to Istvan Szekely of theTroika in the second press conference, he clammed up, which in effect was a denial of any such deal. The dramatis personae for the Troika's conference comprised

I found the Troika conference pretty outrageous. Here was a bunch of foreigners spouting to the Irish people via the Irish media about Irish fiscal policy and performance. And there was not a single Irish elected politician in sight. I know a separate press conference had just taken place, but how can Irish politicians just step aside from the Troika's event and hide like that? Elected Irish representatives, and through them the general Irish populace, have become mere obedient vassals of the unelected Troika, who like seagulls fly in, shit on everybody and fly out again. Top marks, however, to Vincent Browne for skewering the ECB's slippery Klaus Masuch (sounds like a German) who only waffled when asked to justify the demand that Irish taxpayers pay the private gambling losses of the defunct Anglo Irish Bank. As journalist Michael Lewis pointed out some months ago, Anglo only ever had six branches and no ATMs, and its only trade was to borrow tens of billions from European banks and lend it to developers. It had absolutely nothing to do with the general Irish public. Faced with direct questioning, Masuch clammed up in confusion, ably protected by the Troika's local minder Mrs Nolan (who though Irish is however a professional EUrocrat on the EU payroll).

Ireland's pain is all about saving German banks from their own folly and Masuch knows it. Ireland be damned. Ireland surrendered its sovereignty when it agreed to accept loans from the Troika as a result of having brainlessly socialised the private gambling debts of private banks, Anglo Irish among them. What we have seen this week is that ghastly surrender in action. Issue 218’s Comments to Cyberspace

- - - - - C A N A D A - - - - - Quote: “To meet the targets under Kyoto for 2012 would be the equivalent of removing every car truck, all-terrain vehicle, tractor, ambulance, police car and vehicle off every kind of Canadian road.” Peter Kent, Canada's environment

minister, Climate change poseurs

notwithstanding, - - - - - I S R A E L / P A L E S T I N E - - - - - Quote: “Remember, there was no Palestine as a state - (it was) part of the Ottoman Empire. I think we have an invented Palestinian people who are in fact Arabs and historically part of the Arab community and they had the chance to go many places.” Newt Gringrich, US Republican

Presidential Hopeful, Quote: “A distinction should be made between traditional anti-Semitism, which should be condemned and Muslim hatred for Jews, which stems from the ongoing conflict between Israel and the Palestinians.” Howard Gutman, President Obama's US

ambassador to Belgium, It is as if he has never even read a

word of the Koran or its Hadiths “The Hour [Judgment Day] will not come - - - - - € U R O - - - - - Quote: “There might be some assets worthy of consideration — precious metals, for example. But other metals would make wise investments, too. Among them tinned goods and small calibre weapons.” Warren Buffet's Hathaway investment

vehicle gives its advice Quote: “Telling a European that one has to earn her or his health-care benefits or social insurance or pension or access to amenities and infrastructure is equivalent to challenging a brick wall to be flexible and dynamic.” Constantin Gurdgiev, Ireland-based Russian economist - - - - - T O P G E A R - - - - - Quote: “Frankly, I would have them all shot. I would take them outside and execute them in front of their families. I mean how dare they go on strike when they have got these gilt-edged pensions that are going to be guaranteed while the rest of us have to work for a living?” Jeremy Clarkson's solution to strikes by public “servants” in the UK. Unfortunately he later (sort-of)

apologised for his joke. [Of course a joke which offends no-one is never funny.] Coincidentally, sales of Mr Clarkson's latest DVD, “Powered Up”, soared. - - - - - I R E L A N D - - - - - Quote: “Difficult choices are never easy.” Who knew? Ireland's Taoiseach, Enda Kenny, makes

a truly profound observation Indeed, it was only the sixth such

speech since the foundation of the state, Quote: “Connemara ..., as it is open to the Atlantic, [and] in terms of cloud computing, we have dense thick fog for nine months of the year, because of the mountain heights and the ability to harness this cloud power, there is tremendous scope for cloud computing to become a major employer in this region ... the Government should be doing more to harness clean industries for the Connemara area ... wind energy and cloud computing are two obvious examples.” Connemara councillor Seamus O Scanail, Independent, sets out his vision for the regeneration of his windswept constituency. Fellow councillor Martin Shiels remarked that

Late note (20 Jan

2012): |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| See the Archive and Blogroll at top left and right, for your convenience | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Now, for a little [Light Relief]

“”

|

Gift Idea |

||||||||||||||||||||||||||||||||||||||||||||||

Good to report that as at

FREED AT LAST, |

||||||||||||||||||||||||||||||||||||||||||||||

|

BLOGROLL

Atlantic Blog (defunct) Blog-Irish (defunct)

Jihad

Religion

Iona Institute

Leisure

Blog Directory

My Columns in the

|

||||||||||||||||||||||||||||||||||||||||||||||

|

What I've recently

But it's not

entirely honest in its subtle pro-Palestinian bias, and therefore needs

to be read in conjunction with an antidote, such as See detailed review +++++

BP's ambitious CEO John Browne expanded it through adventurous acquisitions, aggressive offshore exploration, and relentless cost-reduction that trumped everything else, even safety and long-term technical sustainability. Thus mistakes accumulated, leading to terrifying and deadly accidents in refineries, pipelines and offshore operations, and business disaster in Russia. The Macondo blowout was but an inevitable outcome of a BP culture that had become poisonous and incompetent. However the book is gravely compromised by a litany of over 40 technical and stupid errors that display the author's ignorance and carelessness. It would be better to wait for the second (properly edited) edition before buying. As for BP, only a wholesale rebuilding of a new, professional, ethical culture will prevent further such tragedies and the eventual destruction of a once mighty corporation with a long and generally honourable history. Note: I wrote

my own reports on Macondo +++++ A horrific account of:

More details on my blog here. +++++

After recounting a childhood of convention and simple pleasures in working-class Aberdeen, Mr Urquhart is conscripted within days of Chamberlain declaring war on Germany in 1939. From then until the Japanese are deservedly nuked into surrendering six years later, Mr Urquhart’s tale is one of first discomfort but then following the fall of Singapore of ever-increasing, unmitigated horror. After a wretched journey Eastward, he finds himself part of Singapore’s big but useless garrison. Taken prisoner when Singapore falls in 1941, he is, successively,

Chronically ill, distraught and traumatised on return to Aberdeen yet disdained by the British Army, he slowly reconstructs a life. Only in his late 80s is he able finally to recount his dreadful experiences in this unputdownable book. There are very few first-person eye-witness accounts of the the horrors of Japanese brutality during WW2. As such this book is an invaluable historical document. +++++

This is a rattling good tale of the web of corruption within which the American president and his cronies operate. It's written by blogger Michele Malkin who, because she's both a woman and half-Asian, is curiously immune to the charges of racism and sexism this book would provoke if written by a typical Republican WASP. With 75 page of notes to back up - in best blogger tradition - every shocking and in most cases money-grubbing allegation, she excoriates one Obama crony after another, starting with the incumbent himself and his equally tricky wife. Joe Biden, Rahm Emmanuel, Valerie Jarett, Tim Geithner, Lawrence Summers, Steven Rattner, both Clintons, Chris Dodd: they all star as crooks in this venomous but credible book. ACORN, Mr Obama's favourite community organising outfit, is also exposed for the crooked vote-rigging machine it is. +++++

It is really just a collation of amusing little tales about surprising human (and occasionally animal) behaviour and situations. For example:

The book has no real message other than don't be surprised how humans sometimes behave and try to look for simple rather than complex solutions. And with a final anecdote (monkeys, cash and sex), the book suddenly just stops dead in its tracks. Weird. ++++++

It's chapters are organised around provocative questions such as

It's central thesis is that economic development continues to be impeded in different countries for different historical reasons, even when the original rationale for those impediments no longer obtains. For instance:

The author writes in a very chatty, light-hearted matter which makes the book easy to digest. However it would benefit from a few charts to illustrate some of the many quantitative points put forward, as well as sub-chaptering every few pages to provide natural break-points for the reader. +++++

The author was a member of Britain's V Force, a forerunner of the SAS. Its remit was to harass Japanese lines of command, patrol their occupied territory, carryout sabotage and provide intelligence, with the overall objective of keeping the enemy out of India. Irwin is admirably yet brutally frank, in his descriptions of deathly battles with the Japs, his execution of a prisoner, dodging falling bags of rice dropped by the RAF, or collapsing in floods of tears through accumulated stress, fear and loneliness. He also provides some fascinating insights into the mentality of Japanese soldiery and why it failed against the flexibility and devolved authority of the British. The book amounts to a very human and exhilarating tale. Oh, and Irwin describes the death in 1943 of his colleague my uncle, Major PF Brennan. +++++ Other books here |

||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

After

48

crackling, compelling, captivating games, the new World Champions are,

deservedly,

England get the Silver,

No-one can argue with

Over the competition, |

||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||

Professional

objectors have already organised themselves into something called

Professional

objectors have already organised themselves into something called

The

price of these loans (wrongly** called a

The

price of these loans (wrongly** called a