|

|

| Blog |

|

| Archive |

|

|

|

|

| Blog |

| To find an archived article, simply click on Index and scroll the subject titles, or do a Ctrl-F search |

TALLRITE BLOG You can write to me at blog2-at-tallrite-dot-com |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

“Ill-informed and

objectionable”;

“You poisonous, bigoted, ignorant, verbose little wa*ker.” (except I'm not little - 1.97m) Reader comments |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Myspace Clocks, Video Clocks, Flash Clocks, Fun Clocks at WishAFriend.com |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

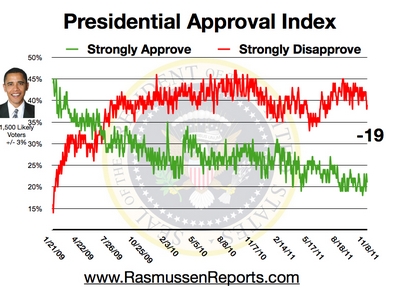

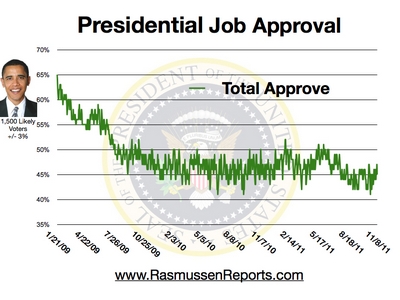

Back to President Obama’s (un)popularity; date is on the charts. (Click to get the latest version.) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

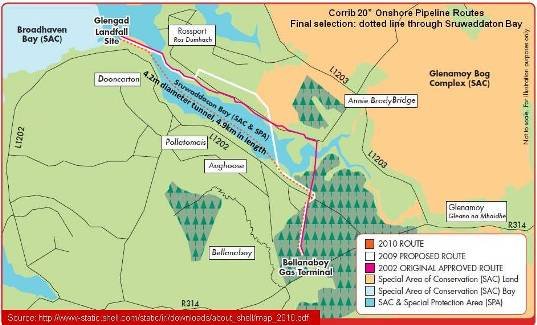

Corrib – Ireland’s Last Offshore Development for a Generation - 26th November

Protests – overwhelmingly unfounded and politically unchallenged – Many years ago, in the late 1970s and early 1980s, there was a Dutch company with an Irish name, Shell Teoranta BV, whose raison d’être was to seek and hopefully find oil offshore Ireland (“Teoranta” is Irish for "“Limited”). It drilled a number of wells – for example, on 19th December 1979, the Irish Times featured a photo of a jack-up rig drilling an exploration well just offshore Dublin – but to no avail. All the holes were dry. Concluding that Ireland was a lost cause, Shell Teoranta packed its bags and shut up shop, though not before claiming a huge write-off from the Dutch taxpayer for all its futile Irish expenditure, a provision of Netherlands law which explains why Shell Teoranta was registered there. Shell reckoned it had better uses for its shareholders' money than to fritter it away on the ultra-long-shots of Irish exploration. Fast forward a few decades and Enterprise Oil, a significant independent British oil company though not in the same league as the majors, disproved Shell's pessimism by discovering, in 1996, a small-to-medium sized gas field offshore Mayo, which it called Corrib. Containing natural gas reserves eventually calculated to be around one TCF, ie a trillion cubic feet (equivalent to the energy of about 170 million barrels of oil), it lay 3,000 metres below the seabed in waters 350 metres deep some 83km off the north west coast of Ireland. Notwithstanding that weather and sea conditions are among Europe's wildest, and that Ireland possesses the barest of offshore oilfield infrastructure, the economics were nevertheless positive – albeit marginally so – thanks largely to the improved (from the oil industry’s standpoint) contract terms promulgated in 1987 by Energy Minister Ray Burke. Enterprise Oil had never before attempted such a demanding project. Yet in the year 2000 it decided to go ahead with bringing Corrib’s hydrocarbons ashore anyway, quickly busying itself with organizing finance, drawing up engineering plans and ordering equipment. Yet its inexperience manifested itself early on and remained long undetected when it failed to discuss in any detail its plans with the local people, listen to their concerns and secure their enthusiastic support. This is an elementary but vital step in the project process that the international oil industry has learnt the hard way over many decades. The world-wide eruption of protests in 1995 at Shell's environmentally sound decision to sink the North Sea platform Brent Spar in the far Atlantic was one of that company's bitterest lessons. This reputational catastrophe showed in starkest terms that it was no longer sufficient for the industry to be right; it must convince those who might be affected (even if only emotionally) by its plans that it is right. Even Greenpeace eventually acknowledged that Shell's original plan would have had minimal ecological impact – Brent Spar had been comprehensively voided of all toxic material and there is anyway little life on the Atlantic seabed at a depth of 2½ kilometers. Shell realised that its prior philosophy of “Trust me” must be replaced by one of “Show me”. Enterprise Oil's failure to ensure that the locals were onside over the Corrib development was a mistake with enormous long term implications, as anyone with but a passing interest in the activist Shell-to-Sea organization will be aware. In April 2002, Shell, chastened no doubt by the voracious acquisition of the US oil companies Arco and Amoco in recent years by its arch-rival BP, splashed out £3.5 billion to buy Enterprise Oil, whose portfolio of assets fitted rather well with Shell's. But like someone sitting down to a lunch of two dozen luscious Gillardeau oysters, the world’s most expensive, only to discover a bad 'un among them, Shell found itself responsible for delivering a demanding major offshore development project in Ireland, by no means a blockbuster, in the country it had with good reason foresworn twenty years earlier. Oh, and its return to Ireland meant it had to refund Shell Teoranta's juicy rebate from the 1980s back to the Dutch taxpayer. Nevertheless, Shell in good faith put together a team, including some Enterprise personnel, to take over the Corrib project. Drawing on its extensive experience and expertise in this type of deep water harsh environment, it reviewed the Enterprise plans and in 2003 agreed a budget of €800,000 and four years. First gas, as it is known, was expected in 2007. In outline, the plan was

In this little-developed, sparsely-populated rural part of County Mayo near the tiny village of Ballinaboy,

Among the necessary legislative consents and authorizations already in place by then were

So all was looking rosy. What could possibly go wrong? Well, quite a lot as it turned out. None of it technical or financial or labour-related, the classical reasons most big projects run into trouble. Shell's first error was not to realise that there was a potential problem with the residents in the Ballinaboy area of County Mayo where the onshore pipeline was to be laid and the gas plant built. Understandably, families were initially fearful that gas explosions might destroy their houses or even kill them. They strongly preferred that the gas plant be located offshore (out of sight out of mind). Enterprise Oil had done very little to explain to the residents not only the project, its robust safeguards and the virtual impossibility of the disaster scenarios they imagined, but also the benefits it was likely to bring to that relatively impoverished area in terms of employment, regeneration and reputation. On the issue of explosion, designing an onshore pipeline is one of the easiest tasks an oil and gas engineer faces.

Thus a properly designed, operated and maintained pipeline simply will not fail, and speculation about failure is pointless. Though the onshore pipeline was (initially) to run within 70 metres of some homes, as for the plant itself, it was sufficiently remote from residents' buildings for them to be unaffected even in the highly unlikely event of a disaster. But by the time, Shell recognised it had a problem with the locals, that problem had transformed from a rational fear to an emotional fury. With the fury came press attention, with that came international interest, with that Corrib became a cause célèbre, and an opportunity for professional objectors everywhere to vent their manufactured spleen at a wicked multinational oil company whose only desire is to destroy the lives of simple natives. Inevitably, Shell's past “sins” were thrown into the pot, notably

The professional objectors have on several occasions been joined by overseas protestors, including the son of Mr Saro-Wiwa. And with the inauguration in November of the left-wing Michael D Higgins as Ireland’s new president, the objectors now number the First Citizen among their supporters. Though some funds are raised via websites, it is unclear who provides the bulk of its funding, but Sinn Fein and other sinister sources have been cited. I have asked the major anti-Corrib pressure group “Shell to Sea” where it gets its money and am still awaiting a reply. Meanwhile, from the moment Shell got involved with Corrib until the present, it has been on the back foot in trying present its side of the story to the world while simultaneously progressing the project.

The project itself has been exemplary in its technical aspects, and indeed in many ways is an industry trailblazer. Shell, and particularly Ireland, should be in the position of bragging to the world of its prowess. Ireland should be using the success of Corrib as a means to attract not just future investment in offshore (and indeed onshore) exploration and production, but also the vast, highly technical contract industry that supports such activities. Instead, the project is conducted almost behind closed doors and talked about in whispers, in the shadow of continuous low-level but toxic protest, for fear of unleashing another round of hysterical tabloid agitation. Earlier this year, a private, low-key purely technical presentation about the project to a select group of about fifty interested engineers had to be cancelled when Shell-to-Sea got wind and threatened to disrupt the meeting and call in the media. For Shell, all these difficulties has pushed up the price tag from €800m to €2.5 billion. But the nation is also paying a terrible cost that, both now and in the future, that no country can afford in these times of financial crisis and meltdown. It is instructive to compare Corrib with other recent major offshore development projects. One such is Norway’s Ormen Lange, in which Shell holds 17% and recently took over the running of the field:

So Ormen Lange, by any measure a bigger more complex project even than Corrib, was delivered on budget in just 3½ years. Corrib, on the other hand, is expected to take twelve years - three times as long as originally planned – and to cost three times its original budget. Have a look at another major construction project in an entirely different industry – aircraft construction. Boeing dreamt up its 787 Dreamliner in January 2003 and eventually delivered it in October 2011. This was 3½ years behind schedule, a big overrun, which was solely due to technical problems, apart from a two-month Boeing Machinists Strike. Corrib’s far greater delay, by comparison, is due not to technical problems at all, nor financial ones nor labour ones. Local politics, and the way they were handled, are entirely to blame. How embarrassing is that? The local politics boil down purely to those objections by local people, and their national and international supporters, to the onshore elements of the project, objections with only the thinnest veneer of legitimacy to start with, and none at all following substantial concessions instituted by Shell, principally

Meanwhile, for the past eight years the politicians have steadfastly looked on with, at best, bemused disinterest and without the slightest concern for Ireland’s industrial reputation. Moreover, enforcement of the law has been low on their priorities and many (including the current president) have overtly supported the activists. So view Corrib from the standpoint of outside investors. A major, innovative project that has encountered no substantive problems in terms of technology, finance or industrial relations, is nevertheless delivered three times over budget and over time, due entirely to local impediments and the complete lack of political will to overcome them. People will look at Ireland, and surely assign it a massive political risk of 200% to 300%. The Corrib experience is such that there will undoubtedly be no further major investments of this nature in Ireland for at least a generation until this one has been forgotten. Even industrial investors in other heavy industries will be looking askance at Ireland and asking themselves if the favourable corporate tax rate of 12½% is really worth the enormous cost of all the political hassle it can expect from local objectors and the spinelessness of politicians. Far better to sink your money in havens such as Somalia and Iraq where the political risk will be much less punitive than in the erstwhile Celtic Tiger. Ireland's chance to showpiece its technical expertise and perhaps secure for itself a permanent corner of the massive, lucrative and long-lasting offshore market for the future is gone. Meanwhile, Shell is licking its wounds and battling on. Eventually, once natural gas finally begins to flow in 2015 (?) it will get its money back as it supplies Ireland with 60% of its gas, but it will be a long long slog.

Declaration of interest:

Late Note: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Criminal Deception by Creditor Banks- 9th November 2011 Creditor banks,

by failing to discount debts they know will never be repaid in full, In the mid-Noughties, Shell was convulsed by a major, almost existential crisis, which, unlike those of a decade earlier, was of an entirely non-technical non-environmental nature. In 2004, Shell confessed that for several years it had been exaggerating its oil reserves by a whopping 3.9 billion barrels, or 20%. A company's oil reserve statement is its best estimate of how much future oil it is able to produce based on current technology, current oil prices and current legislation; the more it has the richer it is. Shell's overstated reserves meant overstated future profits and thus an overstated share price, which promptly crashed wiping out £3 billion of investors' savings As a result, Shell had to pay, inter alia, a $381 million settlement to shareholders, a $120m fine to the US Securities and Exchange Commission and a £17m fine to Britain's Financial Services Authority. Phil Watts the CEO was fired, retired to his secluded mansion in the south of England and dare not ever visit the USA for fear of imprisonment. In other words, the penalties when a private commercial company deceives the markets as to its wealth are very severe. Which brings us to the EU's banking crisis. The PIGIS of €uroland, soon to become the BIPIGS (Belgium, Italy, Portugal, Ireland, Greece, Spain), are facing economic ruin because they each have debts so great that no-one in his/her heart believes they can ever be repaid in full. But if all (or even some) of the BIPIGS default, the €uro will come crashing down and the EU itself will probably split asunder. That is why the EU, aided by the European Central Bank and the International Monetary Fund, have been “bailing out” stricken countries as their debts fall due, in exchange for severe austerity to bring national budgets back into balance (eventually). But the term is a misnomer. If I am in a sinking boat and someone bails me out, it means he scoops out water and throws it out of the boat. The EU/ECB/IMF troika is doing no such thing. Under intense pressure from Germany and France in particular, it is lending money to allow countries like Ireland to pay their debts, but of course those countries still owe the money, just to the troika instead of to the original creditors. In other words, water is being “bailed out” of the prow of the boat and transferred to the aft; it's still sinking just as fast. What is actually getting “bailed-out” is of course the BIPIGS' creditors - those banks and institutions so intrinsically stupid that they lent billions to equally stupid countries like Ireland who were always incapable of repayment. And who are those creditors? Overwhelmingly, they are German and French financial institutions. They are so exposed to the BIPIGS that should they default, the whole Franco-German banking system is in danger of collapse. If that weren't enough, beyond Europe, German banks are also holding up to a hundred billion dollars (some say a trillion dollars) of American sub-prime mortgages, whose utter junkness triggered the current financial tsunami in 2008. But the question to ask is this. Why are these banks carrying these debts on their books at full their value when it is quite obvious that they should be written down to a figure that reflects the very real risk that their creditors will default partially if not totally?

These are just two examples of why the German, French and other bondholding banks and institutions should already have written down the value of their loan books by something in the order of 50%. But they haven't because this would make them look bad and devastate their own share prices. Yet what, exactly, is the qualitative difference between

I would say there is no difference. Yet Shell (rightly) gets fined hundreds of millions and its CEO, in order to escape an American jail, has effectively to go into semi-hiding for life. This gets to the heart of the rottenness of the EU's banking system and the EUrocratic élite who are conspiring to conceal what is in effect a criminal enterprise of deception. Right now, the German and French banks are in deep trouble because they have nothing like the wealth they are pretending to have.

Last year, John Lanchester published an acclaimed book called “Whoops! Why Everyone Owes Everyone and No One Can Pay”. The sooner Merkozy get their arrogant heads around this notion the sooner some kind of solution, involving mass default followed by mass rebuilding, can occur. The more they kick the can down the road with their lies, the bigger the can is getting and the more painful the inevitable outcome will be. Jonathan Swift, in his prescient poem of 1734, “The Run Upon the Bankers”, wrote

But he is wrong, for his verse assumes the bonds will be repaid. But as Mr Lanchester explains, today's mega-giga-bonds will largely not be repaid. As such it is the debtors (which includes the BIPIGS) who have the soul of the Merkozy creditors and their ilk, not the other way round. Putting off the evil day, whether it is through shying away from default or criminally falsifying the balance sheets of creditor institutions, is only making the ultimate day of reckoning far worse.

Simple Principles of Job Creation - 9th November 2011 Creating jobs would be easy if only Governments Everyone is at it.

Telling you how much of other people's money they are

Interestingly not one of these esteemed gentleman has ever, in fact, created a single job in his life. Oh he will tell you about this initiative and that tax concession and the other festival he arranged, which resulted in thousands of new jobs. But in every case he has (a) used other people's money to do what he wanted to do and (b) never met a single payroll himself. The jobs have actually been created by businessmen risking their own cash. The other interesting point is that among the entire political class across the world there is a conviction that it can only create jobs by spending money - money that of course belongs to other people (known as taxpayers). That's why they prefer to talk about “investing”, as this is a more upbeat-sounding euphemism which suggests there might one day be an economic return (ha!). But if these revered Statesmen were to talk to a few actual, you know, businessmen who actually do, you know, create jobs, the scales might fall from their eyes. Because any businessman will tell you that the single biggest obstacle to job creation is the series of roadblocks thrown in his/her path by the State itself. Remove the roadblocks and the jobs will simply follow, just as traffic flows smoothly once you take away the barriers. And the beauty of this is that it costs no money to take stuff away. Yes, job creation is - or can and should be - all gain and no pain. Let me count the ways, or at least some of them.

Will any of this simple shopping list happen? Maybe bits of it here and there. But there is an inherent problem with governing a country, whether through dictatorship or democracy. The governing class believes its function is to make new laws and to perpetuate itself. What candidate campaigns with the slogan “Strike Down Laws”. Yet where is the logic in continually creating new legislation, ad infinitum? Surely it is much more rational first to eliminate or reduce or simplify laws that no longer make sense, and to make new ones only in extremis? Surely each administration should seek to leave office with fewer statutes on the books than it encountered. But it never does. Its instinct is always to do more and to do that it always thinks it has to spend more. Creating jobs by doing less? Just removing barriers and getting the hell out of the way? Letting free workers and free employers make deals together without interference? Perish the thought. That is why ever more hard-working taxpayers' money will be frittered away on “job-creation” wheezes. Yet new jobs will emerge, but only in spite of, not because of, such blundering “assistance” from Governments throughout the Western world. Issue 217’s Comments to Cyberspace

- - - - - L I B Y A - - - - - Quote: “Libyan laws in future will have Sharia, the Islamic code, as its ‘basic source’ ... Libya's ban on polygamy will be lifted ... in future bank regulations will ban the charging of interest, in line with Sharia”. Mustafa Abdul-Jalil, chairman of Libya's National

Transitional Council Is this what it was all for? Quote: “I've come to know Saif [Q'Daffy, son of Moammar] as someone who looks to democracy, civil society and deep liberal values as the core of his inspiration.” David Held, professor of political science Prof Held it was who also accepted a £1.5m donation from

Q'Daffy Jr Prof Held hurriedly resigned in October 2011 just before before

Meanwhile, Q'Daffy Jr remains on the run, - - - - - U S P R E S I D E N C Y - - - - - Quote: “The one thing that we absolutely know for sure is that if we don’t work even harder than we did in 2008 [to get me re-elected], then we’re going to have a government that tells the American people, ‘you are on your own’.” President Obama frightens the horses by horrifying them

with the notion Imagine such an abysmal scenario: Quote: “I have never sexually harassed anyone. Yes, I was falsely accused while I was at the National Restaurant Association ... When there are facts, bring them to me, let me face my accusers.” Oh-oh. Herman Cain, the

Republican's new, charismatic, This could well mark the end of his bid. - - - - - I S R A E L - - - - - Quote: “I can't stand him [Benyamin Netanyahu] anymore, he's a liar.” President Sarkozy moans to President Obama about the leader of a mutual ally.

“You may be sick of him, but me, I have to deal with him every

day”, Why doesn't someone just rid the world

of that turbulent Zionist entity? - - - - - I T A L Y - - - - -

Beautiful brunette Francesca Pascale, 25,

Late on the night of desperate negotiations

to keep his job as prime minister, Hat tip: Philip O'Sullivan

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| See the Archive and Blogroll at top left and right, for your convenience |

Now, for a little [Light Relief]

“”

|

Gift Idea |

||||||||||||||||||||||||||||||||||||||||||||||

Good to report that as at

FREED AT LAST, |

||||||||||||||||||||||||||||||||||||||||||||||

|

BLOGROLL

Atlantic Blog (defunct) Blog-Irish (defunct)

Jihad

Religion

Iona Institute

Leisure

Blog Directory

My Columns in the

|

||||||||||||||||||||||||||||||||||||||||||||||

|

What I've recently

But it's not

entirely honest in its subtle pro-Palestinian bias, and therefore needs

to be read in conjunction with an antidote, such as See detailed review +++++

BP's ambitious CEO John Browne expanded it through adventurous acquisitions, aggressive offshore exploration, and relentless cost-reduction that trumped everything else, even safety and long-term technical sustainability. Thus mistakes accumulated, leading to terrifying and deadly accidents in refineries, pipelines and offshore operations, and business disaster in Russia. The Macondo blowout was but an inevitable outcome of a BP culture that had become poisonous and incompetent. However the book is gravely compromised by a litany of over 40 technical and stupid errors that display the author's ignorance and carelessness. It would be better to wait for the second (properly edited) edition before buying. As for BP, only a wholesale rebuilding of a new, professional, ethical culture will prevent further such tragedies and the eventual destruction of a once mighty corporation with a long and generally honourable history. Note: I wrote

my own reports on Macondo +++++ A horrific account of:

More details on my blog here. +++++

After recounting a childhood of convention and simple pleasures in working-class Aberdeen, Mr Urquhart is conscripted within days of Chamberlain declaring war on Germany in 1939. From then until the Japanese are deservedly nuked into surrendering six years later, Mr Urquhart’s tale is one of first discomfort but then following the fall of Singapore of ever-increasing, unmitigated horror. After a wretched journey Eastward, he finds himself part of Singapore’s big but useless garrison. Taken prisoner when Singapore falls in 1941, he is, successively,

Chronically ill, distraught and traumatised on return to Aberdeen yet disdained by the British Army, he slowly reconstructs a life. Only in his late 80s is he able finally to recount his dreadful experiences in this unputdownable book. There are very few first-person eye-witness accounts of the the horrors of Japanese brutality during WW2. As such this book is an invaluable historical document. +++++

This is a rattling good tale of the web of corruption within which the American president and his cronies operate. It's written by blogger Michele Malkin who, because she's both a woman and half-Asian, is curiously immune to the charges of racism and sexism this book would provoke if written by a typical Republican WASP. With 75 page of notes to back up - in best blogger tradition - every shocking and in most cases money-grubbing allegation, she excoriates one Obama crony after another, starting with the incumbent himself and his equally tricky wife. Joe Biden, Rahm Emmanuel, Valerie Jarett, Tim Geithner, Lawrence Summers, Steven Rattner, both Clintons, Chris Dodd: they all star as crooks in this venomous but credible book. ACORN, Mr Obama's favourite community organising outfit, is also exposed for the crooked vote-rigging machine it is. +++++

It is really just a collation of amusing little tales about surprising human (and occasionally animal) behaviour and situations. For example:

The book has no real message other than don't be surprised how humans sometimes behave and try to look for simple rather than complex solutions. And with a final anecdote (monkeys, cash and sex), the book suddenly just stops dead in its tracks. Weird. ++++++

It's chapters are organised around provocative questions such as

It's central thesis is that economic development continues to be impeded in different countries for different historical reasons, even when the original rationale for those impediments no longer obtains. For instance:

The author writes in a very chatty, light-hearted matter which makes the book easy to digest. However it would benefit from a few charts to illustrate some of the many quantitative points put forward, as well as sub-chaptering every few pages to provide natural break-points for the reader. +++++

The author was a member of Britain's V Force, a forerunner of the SAS. Its remit was to harass Japanese lines of command, patrol their occupied territory, carryout sabotage and provide intelligence, with the overall objective of keeping the enemy out of India. Irwin is admirably yet brutally frank, in his descriptions of deathly battles with the Japs, his execution of a prisoner, dodging falling bags of rice dropped by the RAF, or collapsing in floods of tears through accumulated stress, fear and loneliness. He also provides some fascinating insights into the mentality of Japanese soldiery and why it failed against the flexibility and devolved authority of the British. The book amounts to a very human and exhilarating tale. Oh, and Irwin describes the death in 1943 of his colleague my uncle, Major PF Brennan. +++++ Other books here |

||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

After

48

crackling, compelling, captivating games, the new World Champions are,

deservedly,

England get the Silver,

No-one can argue with

Over the competition, |

||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||